ECTA members get on board with low emission fuels

As shown in the ECTA Responsible Care KPIs for 2024, the ECTA members are supporting the transition to low emission fuels like HVO. HVO stands for Hydrotreated Vegetable Oil which is a new type of renewable diesel fuel which can be used as a “drop-in” replacement for fossil diesel in trucks. The headline is that the percentage of the fleet that are using HVO has increased rapidly to 15% from 3% in 2023. This does not mean that 15% of the fuel used is HVO but that 15% of the fleet are using it some of the time.

The conditions that make it commercially viable vary by country which changes over time. For example, in 2024 the HVO-100 cost and availability were good in Norway, Sweden, Italy, Belgium and Austria but in the Netherlands it remains too expensive. Our members also point out that availability in France is a little more complex as a local installation for fuel distribution is required. It is widely felt that customers are often requesting HVO as a way to reduce their pipeline GHG emissions but they are often unwilling to pay extra for this. Limited data on HVO cost trends are shown in Chart B below.

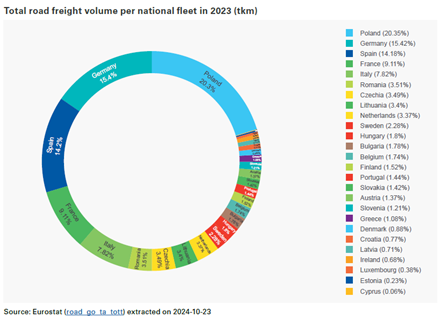

The popularity of HVO as an interim solution in the progress towards zero emissions is further supported in a recent paper from the IRU. The intelligence briefing entitled “Alternative vs traditional truck powertrains in the EU – total cost of ownership 2024” uses data from France, Germany, Poland, Spain and Italy which are the five biggest EU road freight countries (see Chart A). The report concludes that “HVO currently provides the most optimal balance between Total Cost of Ownership and CO2 emissions in all five countries”.

There is however a note of caution in the report about the sustainability of supply of HVO as a fuel. It states that “HVO production is, and will remain, limited, raising questions about its long term availability and pricing”. It goes on to say that “it is important to note that production levels will be limited compared to the needs of road transport, maritime and aviation. To put it in perspective, the total HVO production forecast for 2050 would cover less than a third of truck and bus needs, and only if all European production was consumed”.

So we must conclude that HVO only provides an interim solution until such time as zero emission vehicle technologies become more affordable. Until then, transport companies will seek to maximise its use especially where customers are willing to share the additional costs.